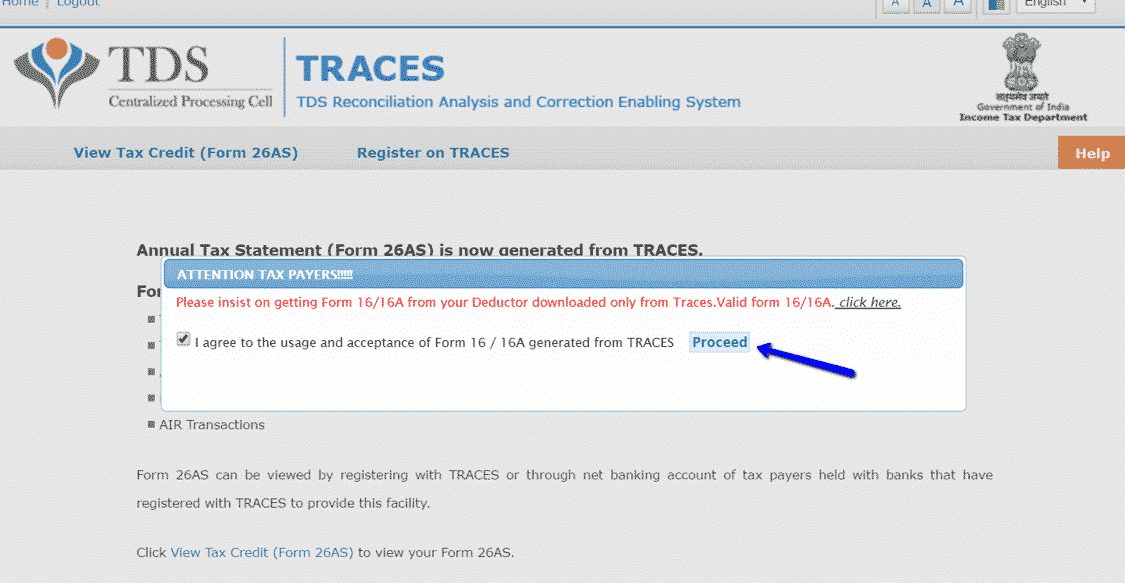

In any variation, you are welcome to get the income tax notice.Īlso Read: Shares Fundamental Analysis (Complete Guide) The IT department also tallies all your tax deduction details provided by you by Form 26AS. Income Tax department keeps all your tax-related data in their database through 26AS.

0 kommentar(er)

0 kommentar(er)